Factoring

Factoring is a short term loan that provides liquidity to the business immediately and enables the business to increase its turnover in the form of us buying your accounts receivable as you will not have to wait till the end of the credit term for payment from your customers.

IFS will give you cash advancement of up to 90% against your receivables within 24 hours (on a business day) after you have submitted invoices and other relevant trade documents to IFS.

สินเชื่อ Small Business กล้าโต

สินเชื่อธุรกิจระยะสั้นเพื่อผู้ประกอบการรายย่อย แบบไม่มีหลักทรัพย์ค้ำประกัน เพียงยื่นเอกสารการค้ามาเปลี่ยนเป็นเงินทุน ไม่ต้องรอครบเครดิตก็สามารถรับเงินล่วงหน้าได้ทันที

สินเชื่อระยะสั้น

“แฟคเตอริ่ง” เปลี่ยนลูกหนี้การค้าเป็นเงินสดใช้เพียงเอกสารการค้า เช่น ใบแจ้งหนี้, ใบวางบิล, และอื่นๆ ในการทำธุรกรรมสินเชื่อสามารถรับเงินล่วงหน้าได้ภายใน 1 วันทำการ

- ไม่ใช้หลักทรัพย์ค้ำประกัน

- วงเงินสินเชื่อ 2 - 5 ล้านบาท*

- รับเงินล่วงหน้าสูงสุด 90% (ของมูลค่าเอกสาร)

อัตราดอกเบี้ยและค่าใช้จ่าย

- อัตราดอกเบี้ยต่อปี

- ค่าธรรมเนียมเปิดบัญชีวงเงิน

- ค่าธรรมเนียมแฟคเตอริ่ง

คุณสมบัติเบื้องต้นของผู้ใช้บริการ

- เป็นนิติบุคคลที่เปิดดำเนินกิจการมาไม่ต่ำกว่า 1 ปี*

- จดทะเบียนเป็นผู้ประกอบการในระบบภาษีมูลค่าเพิ่ม*

- มียอดขายเฉลี่ยเดือนละ 1 ล้านบาทขึ้นไป*

- ขายสินค้าหรือบริการเป็นเครดิตให้ลูกค้ารายใหญ่

- ให้เครดิตเทอมแก่คู่ค้า 7-180 วัน

เอกสารที่ใช้ในการประกอบการพิจารณาสินเชื่อ (เบื้องต้น)

- เอกสารหนังสือรับรองจัดตั้งบริษัท

- เอกสาร ภ.พ.30 ย้อนหลัง 1 ปี

- เอกสารงบการเงิน ย้อนหลัง 1 ปี

- เอกสารรายการเดินบัญชี (Statement) ของกิจการย้อนหลัง 6 เดือน

- รายชื่อลูกหนี้การค้ารายใหญ่ 1-3 รายหลัก

*เงื่อนไขการพิจารณาสินเชื่อเป็นไปตามเกณฑ์ที่บริษัทกำหนด*

Advantages

Advantages to your business

Increase the cash flow of your business immediately.

Collateral is not required to guarantee the factoring facility.

Interest rate is competitive and comparable to the commercial banks.

It is fast and convenient as you can receive cash advancement within 24 hours (on a business day).

The expenses from factoring transactions can be recorded in full for tax deduction.

IFS provides debtors administration and cheque collection services which relieves you of the time-consuming tasks of sales ledgering and credit management.

Our factoring Business

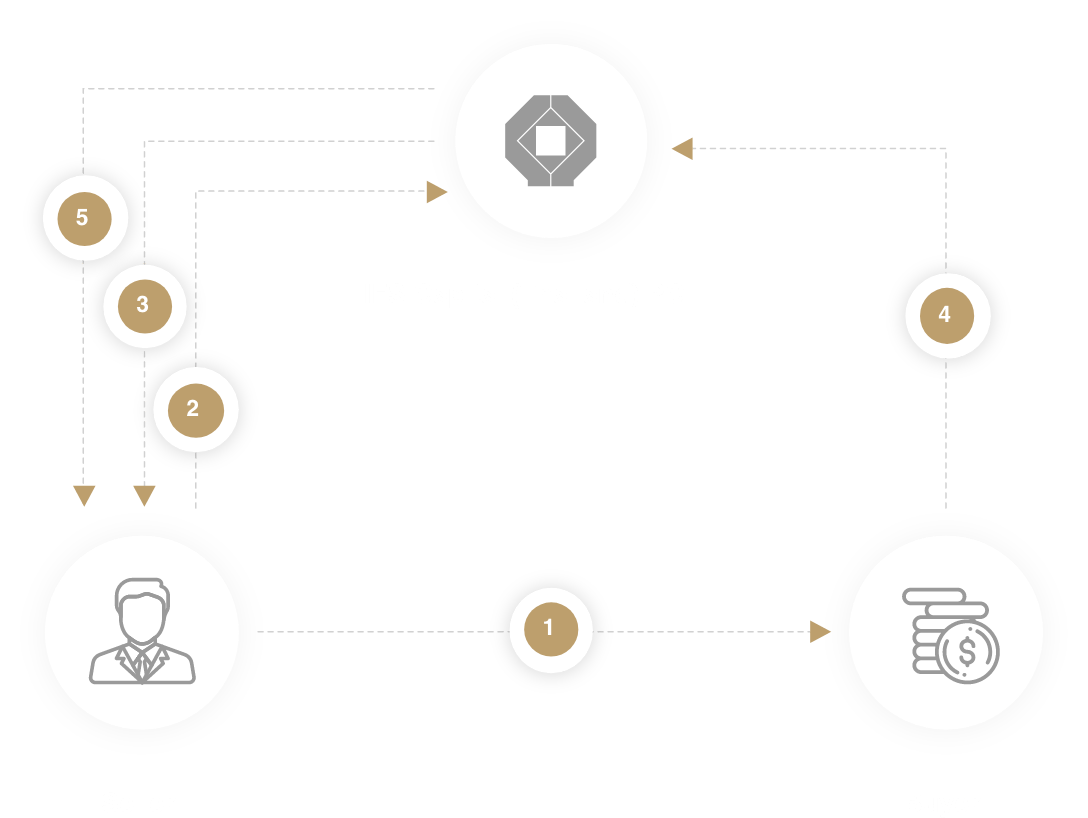

Factoring for Domestic Business

- Seller delivers goods or services to the domestic buyer in accordance with the agreed purchase order.

- Seller submits all commercial documents to IFS for cash advancement.

- IFS will give you cash advancement of up to 90% of the invoice value within 24 hours (of a business day) after you submit the invoices and other trade document to IFS.

- Buyer makes payment to IFS upon invoices due date.

- IFS will refund the remaining amount after deducting the interest, factoring charge and any other miscellaneous charges to you.

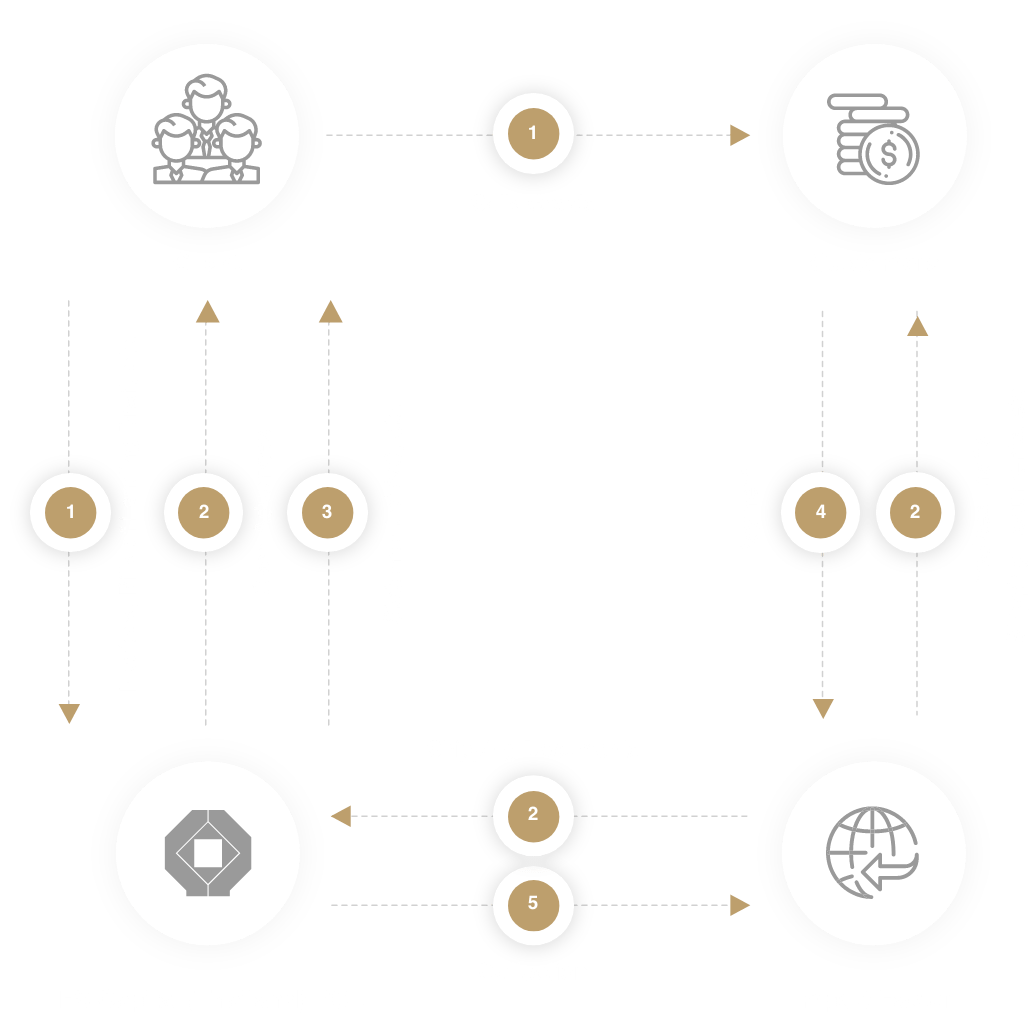

Factoring For Export Business

- Seller delivers goods or services to the overseas buyer according to the agreed purchase order.

- Seller submits all commercial documents including export documents to IFS for cash advencement with out waiting for the goods to arrive at the customer's place.

- (T) will give you cash advancement of up to 90% of the invoice value within 24 hours (on a business day) after you submit the invoices and other trade document to IFS.

- Buyer makes payment to IFS upon due date of invoices.

- IFS will refund the remaining amount after deducting the interest, factoring charge and any other miscellaneous charges.

- 100% credit protection

- 120 days guaranteed payment period

- Overseas collection in the respective countries languages

- Enable Thai Exporters to compete with the other Asian exporters on open account terms.