- About IFS Capital Group

- เกี่ยวกับเรา

- นักลงทุนสัมพันธ์

Getting discounts on purchasing goods or raw materials is a crucial factor in making your business competitive. It gets even better when you receive these discounts while paying according to credit terms.

Getting discounts on purchasing goods or raw materials is a crucial factor in making your business competitive. It gets even better when you receive these discounts while paying according to credit terms.

Supply Chain Finance (SCF) is a platform that offers you, as a large buyer, the opportunity to receive trade discounts from your suppliers while your suppliers is given the option to get paid for their goods/services before the original due date.

IFS Capital will act as an intermediary to advance the payment to your suppliers first and you settle the payments with IFS Capital upon the original due date.

Besides freeing you from the upfront payment burdens, you will also receive trade discounts from IFS Capital when your suppliers use this platform to receive early payments.

*หลักกรอกข้อมูลครบ เจ้าหน้าที่จะติดต่อภายในหนึ่งวันทำการ

Getting discounts on purchasing goods or raw materials is a crucial factor in making your business competitive. It gets even better when you receive these discounts while paying according to credit terms.

Getting discounts on purchasing goods or raw materials is a crucial factor in making your business competitive. It gets even better when you receive these discounts while paying according to credit terms.

Supply Chain Finance (SCF) is a platform that offers you, as a large buyer, the opportunity to receive trade discounts from your suppliers while your suppliers is given the option to get paid for their goods/services before the original due date.

IFS Capital will act as an intermediary to advance the payment to your suppliers first and you settle the payments with IFS Capital upon the original due date.

Besides freeing you from the upfront payment burdens, you will also receive trade discounts from IFS Capital when your suppliers use this platform to receive early payments.

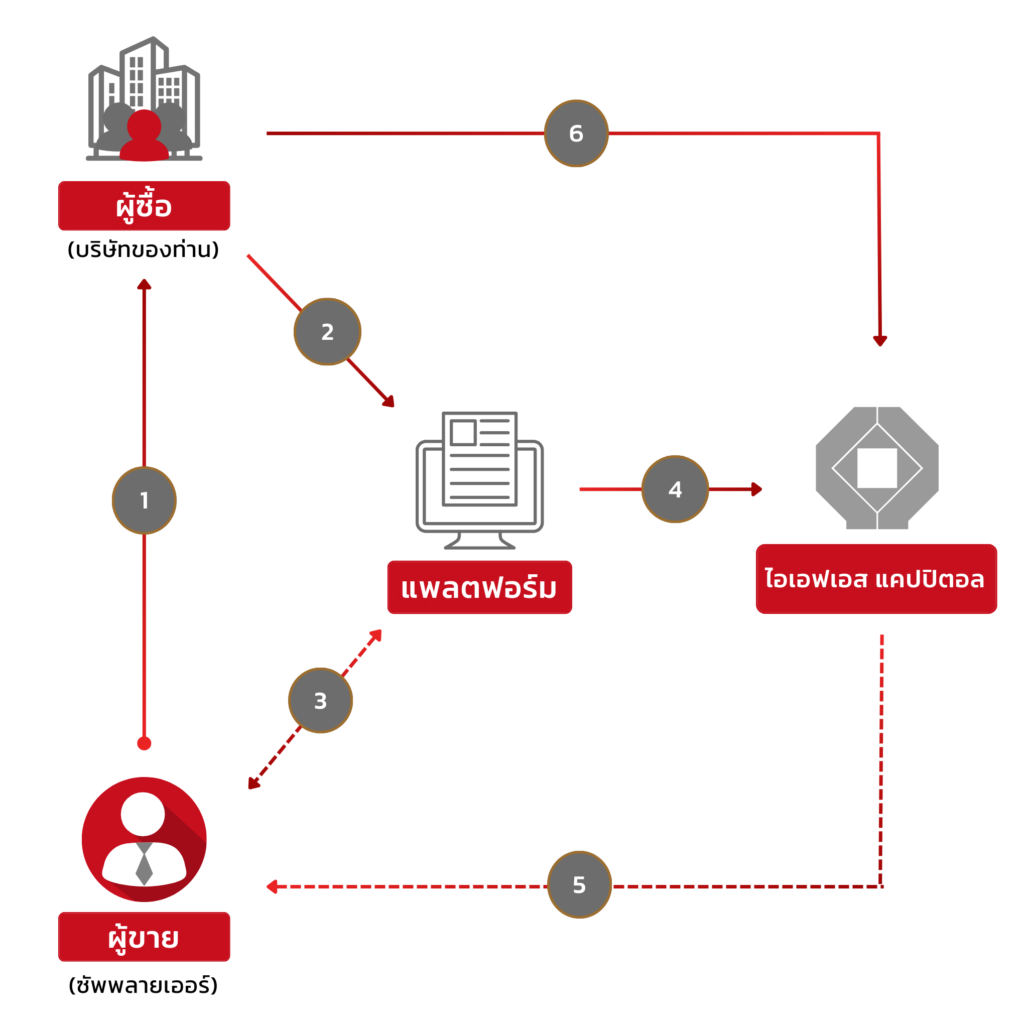

บริการสินเชื่อหมุนเวียนธุรกิจ/คู่ค้า หรือ Supply Chain Finance คือ บริการสินเชื่อหมุนเวียนธุรกิจ ที่จะเข้ามาเป็นตัวกลางระหว่าง ผู้ซื้อ (Buyer) และผู้ขาย (Seller) ช่วยเสริมสภาพคล่องในการชำระค่าสินค้าด้วยการยืดระยะเครดิตเทอมให้นานขึ้น และการเรียกเก็บค่าสินค้ากับผู้ค้า ได้รับชำระเงินค่าสินค้าที่เร็วขึ้น ผ่านระบบ IFS Supply Chain Finance ที่มีความสะดวก ปลอดภัย และรวดเร็ว ทำให้การดำเนินธุรกิจของท่านเป็นเรื่องง่าย ด้วยวิธีการง่ายๆไม่กี่ขั้นตอนในการให้ ผู้ซื้อ (Buyer) และ ผู้ขาย (Seller) ยื่นเอกสารเกี่ยวกับการซื้อ/ขาย เช่น ใบสั่งซื้อสินค้า ใบกำกับภาษี ใบวางบิล ผ่านระบบ IFS Supply Chain Finance

ไอเอฟเอสแคปปิตอล (IFS Capital) จะเข้ามาเป็นตัวกลางระหว่างผู้ซื้อและผู้ขาย เพื่อช่วยลดระยะเวลาค้างจ่ายในการทำธุรกิจที่ล่าช้า (เครดิตเทอม) ที่สร้างปัญหาสภาพคล่องทางการเงินในการทำธุรกิจ เพียงเท่านี้ก็จะทำให้การดำเนินธุรกิจของท่านเป็นไปได้อย่างราบรื่น ลดปัญหาที่จะเกิดการขาดสภาพคล่อง ให้ IFS Supply Chain Finance เข้ามาเป็นผู้ช่วยในการเชื่อมต่อในธุรกิจของท่าน

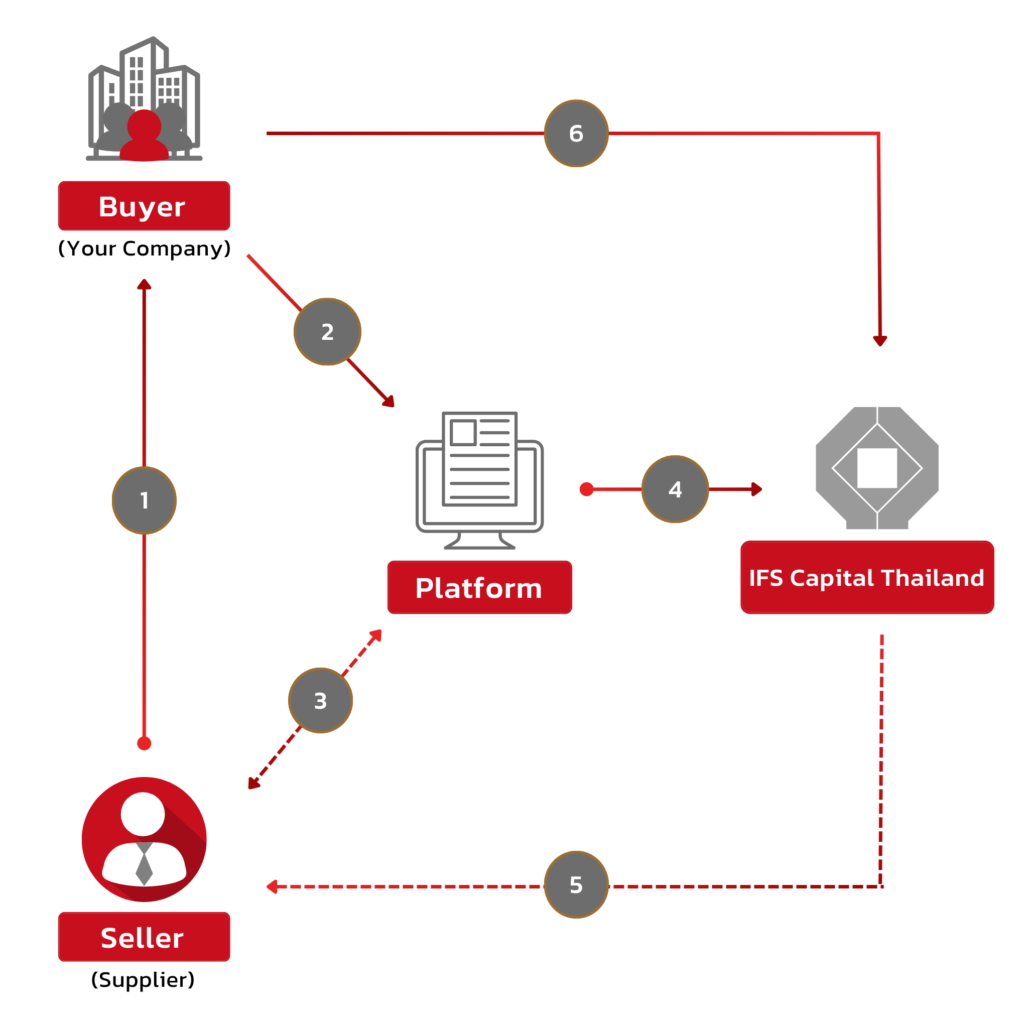

Supply Chain Finance is a Buyer-lead financing solution where IFS Capital acts as an intermediary to help Buyer provide early payments to Sellers, which otherwise might be challenging under normal lending criteria. The financing is made available to all suppliers for approved invoices and can be drawn when required.

The seller delivers the goods or services to the buyer and notify an invoice.

Buyer upload invoice on the platform .

The seller submits a request for advance payment.

An advance payment request is sent to IFS Capital.

The seller receives an upfront payment of up to 100% of the invoice value after deducting interest.

IFS Capital accepts payments from buyers.

เพียงใช้บริการสินเชื่อหมุนเวียนธุรกิจ/คู่ค้า (Supply Chain Finance) กับ IFS Capital ในการเพิ่มทุนหมุนเวียนมาใช้ในการทำธุรกิจ สามารถทำได้ง่าย ๆ ตามขั้นตอนต่อไปนี้เลย

ผู้ขายส่งมอบสินค้าหรือบริการไปยังผู้ซื้อ และแจ้งวางบิล

ผู้ซื้ออัปโหลดเอกสารทางการค้าบนแพลตฟอร์ม

ผู้ขายยื่นคำขอรับชำระเงินล่วงหน้า

คำขอรับชำระเงินล่วงหน้าถูกส่งไปยัง IFS Capital

ผู้ขายรับเงินชำระล่วงหน้าสูงสุดถึง 100% ของมูลค่าใบแจ้งหนี้หลังหักค่าดอกเบี้ย

IFS Capitalรับชำระเงินจากผู้ซื้อ

IFS Capital พร้อมให้บริการสินเชื่อหมุนเวียนธุรกิจ/คู่ค้า (Supply Chain Finance) ตัวกลางที่จะช่วยดูแลด้านการชำระหนี้การค้าระหว่างผู้ซื้อ (Buyer) และผู้ขาย (Seller) พร้อมช่วยเสริมสภาพคล่องให้กับบริษัทคุณ โดยผู้ขายสามารถรับเงินชำระล่วงหน้าสูงสุดถึง 100% ของมูลค่าใบแจ้งหนี้หลังหักค่าดอกเบี้ย

IFS Capital offers revolving credit services designed to enhance liquidity for your company through Supply Chain Finance. We facilitate trade debt payments between buyers and sellers, allowing sellers to receive an advance payment of up to 100% of the invoice value, minus interest.

0-2285-6335, 0-2679-9157

IFS Capital (Thailand) PCL.

@ifscapthai

IFS Capital (Thailand) PCL.