- About IFS Capital Group

- เกี่ยวกับเรา

- นักลงทุนสัมพันธ์

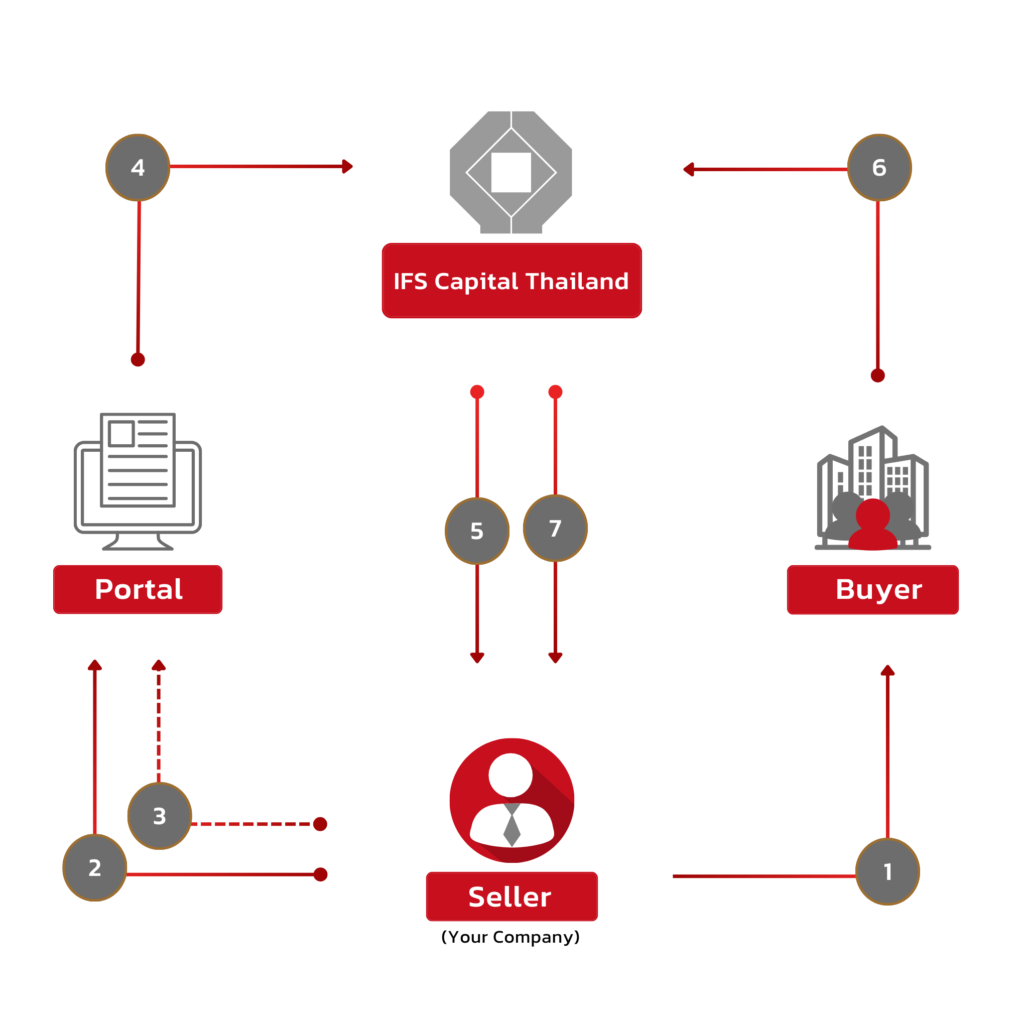

e-Factoring service is an extension of our existing factoring service. With e-Factoring, you can simply upload e-Invoice/e-Tax Invoice along with other supporting documents to our e-Factoring platform. There is no need to submit physical invoices and supporting documents to our office anymore.

In today’s fast-paced business environment, entrepreneurs rely on various commercial documents such as purchase orders, delivery notes, invoices, billing statements, etc. to conduct transactions with trading partners. Traditional paper-based processes incur additional costs for materials and delivery. If there is any delays or loss of the documents, it can lead to late payments and billing complications, impacting your cash flow and operations.

With e-Factoring, Entrepreneurs can now submit electronic invoices (e-Invoice) or electronic tax invoices (e-Tax Invoice) quickly through online channels. It is convenient and fast. You can receive your money within 24 hours.

The advantages of using e-Factoring loan application system are as follows:

It’s different from sending general factoring documents. Reduce document management steps Increase convenience and speed and safer than before With the electronic e-Factoring system with IFS Capital (Thailand).

This website uses cookies for the purpose of improving the user experience. You can learn more details in the Cookie Policy.

You can choose your cookie settings by turning on/off each type of cookie as needed, except for necessary cookies.

Accept All